VA MORTGAGES

A VA loan is possibly the best residential mortgage in the country for various reasons. Firstly, VA rates tend to be extremely competitive. This will vary from lender to lender but for the most part, VA rates will always be better than conventional. Secondly, VA offers 100% financing with zero monthly mortgage insurance. This is a huge advantage versus conventional and especially FHA loans.

How To Qualify for a VA Loan?

- Must Have minimum 580 credit score.

- Acceptable VA entitlement

- Active military, reservists, veterans are eligible

- Must be able to show income **W2/1009 income, fixed income and/or military compensation are all suitable sources of income**

VA PURCHASE LOANS

- 100% financing. No down payment is required.

- No monthly mortgage insurance.

- We offer incredibly low VA rates.

- Non-military spouse can be a co-borrower.

- Flexible underwriting + seller paid closing costs okay.

- 30/15 year fixed loans + Government regulated ARM’s.

- We can cover closing costs with a lender credit.

- VA funding fee can be waived if borrower has VA related disability.

Colorado is a great State for VA loans considering we have so many military bases and active military personnel. For those who have VA benefits and are considering purchasing a home, a VA loan should be their first option!

VA REFINANCE LOANS

IRRRL STREAMLINE

- Refinance current VA loan to reduce interest rate or change term.

- No appraisal required and you do not have to requalify for the loan as long as mortgage payments are made on time

- No income verification(no paystubs, w2s, etc.). Must verify employment.

- No appraisal.

- Fast process that typically takes less than 10 days.

- 212 days must pass from the date the first payment was due on the current VA loan.

VA CASH-OUT

- Borrow up to 100% of your home’s value to consolidate debt or get cash at closing.

- 90% loan to value offers better rates.

- 580 minimum credit score.

- Must be primary residence.

- Please see our Cash-Out page for more details.

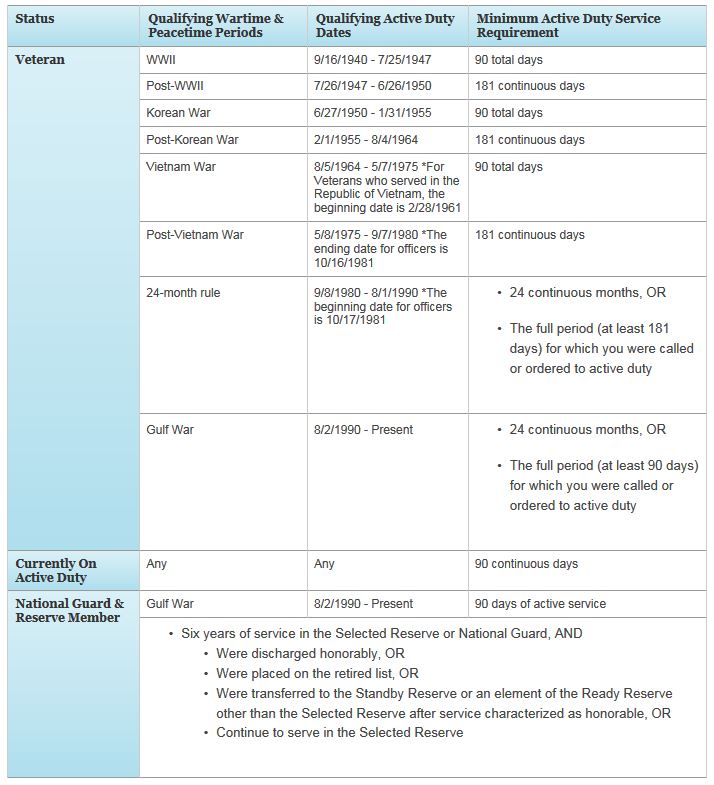

WHO IS ELIGIBLE FOR A VA LOAN

- Eligibility may be used more than once per the guidelines below:

- Veterans can have previously-used entitlement “restored” to purchase another home with a VA loan if:

- The property purchased with the prior VA loan has been sold and the loan paid in full, or

- A qualified Veteran-transferee (buyer) agrees to assume the VA loan and substitute his or her entitlement for the same amount of entitlement originally used by the Veteran seller. The entitlement may also be restored one time only if the Veteran has repaid the prior VA loan in full, but has not disposed of the property purchased with the prior VA loan.

A Veteran is eligible if they meet one of the following:

- Currently active in the Regular Military

- Currently participating in the Reserves or National Guard

- Former National Guard that meets the minimum length of service under Title 32

- Currently employed by the Public Health Services or the National Oceanic and Atmospheric Administration Officer Corps

- Discharged due to physical disability sustained while on military duty

- Regular Military clients need to be separated with a non-dishonorable discharge.

- Reserve and National Guard clients need to be separated with an honorable discharge or placed on the retired list.

A veteran who is classified as “retiree-discharged,” when any of the following occur:

- Once they are discharged from the Military.

- Are transferred to the retired reserve.

Spouses of veterans may also be eligible for VA financing if they fit into the guidelines below.

• Spouse of a veteran who died while is service or from a disability resulting from their service

• Spouse of a veteran who is a prisoner of war or missing in action

• Surviving spouse who remarries on or after attaining age 57, and on or after December 16, 2003

(Note: a surviving spouse who remarried before December 16, 2003, and on or after attaining age 57, must have applied no later than December 15, 2004, to establish home loan eligibility. VA must deny applications from surviving spouses who remarried before December 6, 2003 that are received after December 15, 2004.)

NOTE – If you are eligible for VA financing per the criteria above, you may visit the VA portal to see what documentation will be required before applying for the loan with a VA lender (EX: DD214 for active duty).